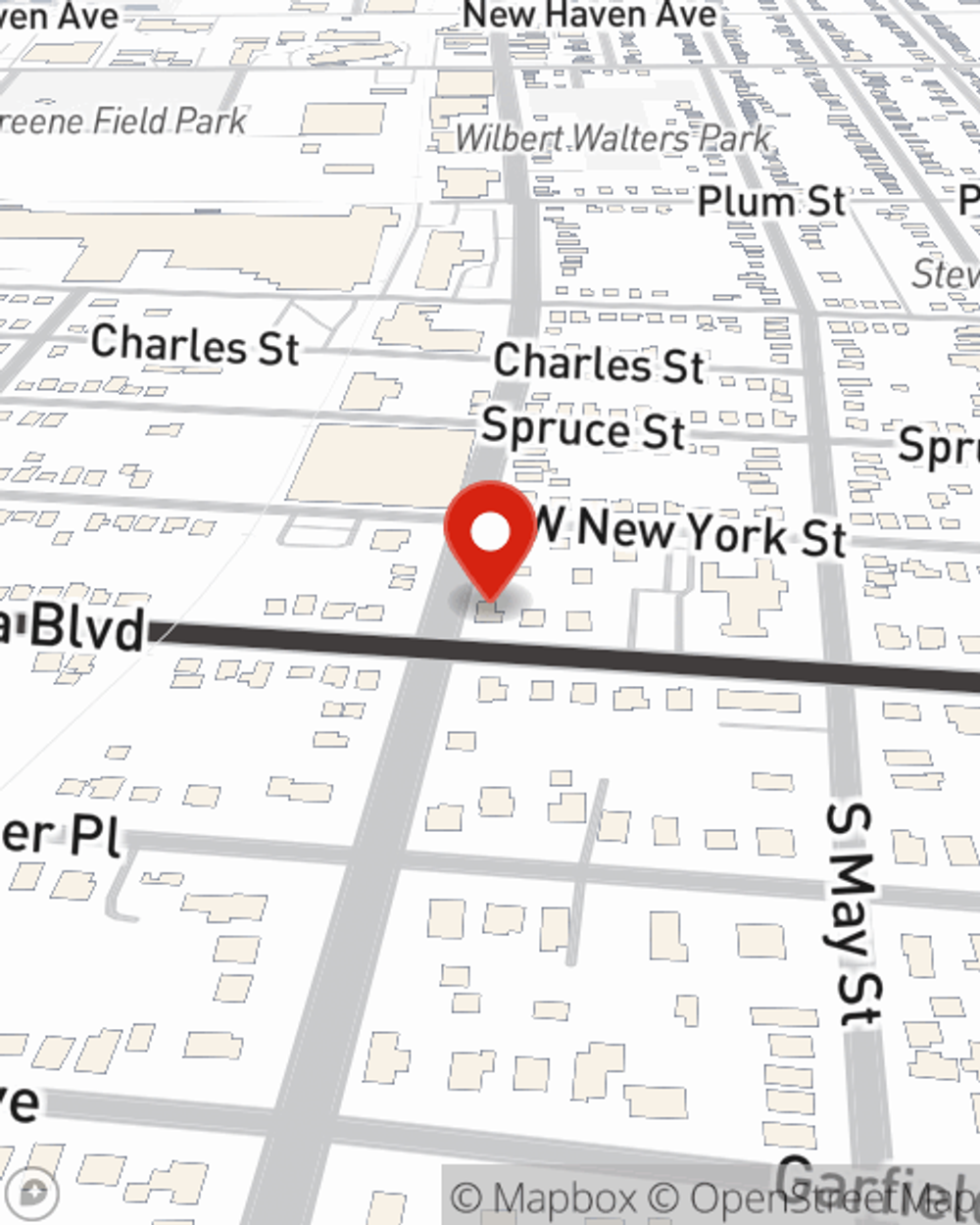

Homeowners Insurance in and around Aurora

Homeowners of Aurora, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- AURORA

- BATAVIA

- BIG ROCK

- BOLINGBROOK

- DEKALB

- DOWNERS GROVE

- ELBURN

- ELGIN

- GENEVA

- LISLE

- MONTGOMERY

- NAPERVILLE

- NORTH AURORA

- OSWEGO

- PLAINFIELD

- PLANO

- SANDWICH

- ST CHARLES

- SUGAR GROVE

- WARRENVILLE

- WEST CHICAGO

- WOODRIDGE

- YORKVILLE

Insure Your Home With State Farm's Homeowners Insurance

You want your home to be a place to laugh and play when you're tired from another long day. That doesn't happen when you're worrying about making sure you don't burn the cake, and especially if your home isn't covered. That's why you need us at State Farm, so all you have to worry about is the first part.

Homeowners of Aurora, State Farm has you covered

Give your home an extra layer of protection with State Farm home insurance.

Agent Omar Delgado, At Your Service

Your home is the cornerstone for the life you hold dear. That’s why you need State Farm homeowners insurance, just in case the unexpected happens. Agent Omar Delgado can roll out the welcome mat to help set you up with a plan for your particular situation. You’ll feel right at home with Agent Omar Delgado, with a straightforward experience to get dependable coverage for your homeowner insurance needs. Personalized care and service like this is what sets State Farm apart from the rest. Home can be a sweet place to live with State Farm homeowners insurance.

Whether you're prepared for it or not, the unexpected can happen. But with State Farm, you're always prepared, so you can take it easy knowing that your belongings are secure. Additionally, if you also insure your auto, you could bundle and save! Contact agent Omar Delgado today to go over your options.

Have More Questions About Homeowners Insurance?

Call Omar at (630) 897-9900 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

Omar Delgado

State Farm® Insurance AgentSimple Insights®

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.